Solana (SOL) is attempting to recover from a nearly 12% correction over the past seven days. The RSI has spiked into overbought territory, indicating strong bullish momentum. However, BBTrend remains highly negative—although it is starting to soften, hinting at a potential stabilization.

Meanwhile, the EMAs are setting up for a possible golden cross, signaling that a trend reversal could be forming if key resistance levels are broken. However, with Ethereum surpassing Solana in DEX volume for the first time in six months and key support levels not far below, SOL remains in a fragile position.

SOL RSI Now Overbought

Solana's relative strength index (RSI) has spiked to 72.91, up sharply from 38.43 a day earlier—signaling a rapid move from neutral to strong bullish territory.

The RSI is a widely used momentum oscillator that measures the speed and magnitude of price movements on a scale of 0 to 100.

A reading above 70 typically indicates that an asset is overbought and could be about to decline, while a reading below 30 indicates oversold conditions and potential for a recovery.

SOL RSI. Source: Trading.

With Solana's RSI now above 70, the asset has officially entered overbought territory, reflecting strong short-term buying pressure.

While this can sometimes foreshadow a correction or consolidation, it can also signal the start of a breakout rally.

Traders should keep a close eye on signs of continuation or exhaustion. If the bullish momentum holds, Solana could move higher, but any stalling could trigger profit-taking and short-term volatility.

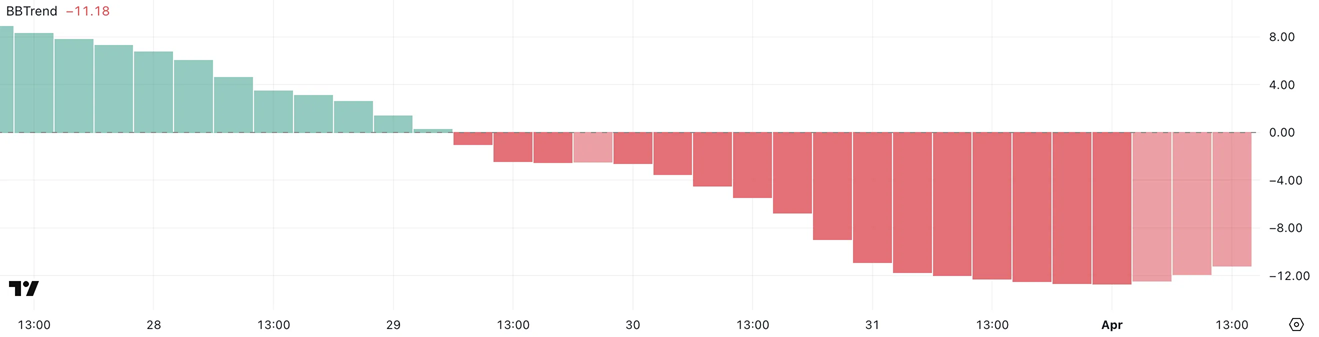

Solana BBTrend is bearish, but remains highly negative

Solana's BBTrend indicator has edged up slightly to -11.18 after hitting a low of -12.68 earlier today. That suggests that bearish momentum is starting to ease.

BBTrend (Bollinger Band Trend) measures the strength and direction of a trend based on how price interacts with the Bollinger Bands.

A reading below -10 typically indicates strong bearish pressure, while a reading above +10 reflects strong bullish momentum. A BBTrend rise from deep negative territory could be an early sign of a potential reversal or at least a slowdown in the downtrend.

SOL BBTrend. Source: Transactions.

With SOL’s BBTrend still in bearish territory but improving, the market may be trying to stabilize after a period of strong sell-off.

However, developments in the broader ecosystem complicate the technical picture. For example, Ethereum recently surpassed Solana in DEX volume for the first time in six months.

While BBTrend is dropping hints of a potential recovery, Solana still needs a stronger confirmation to completely change the trend in its favor. Until then, cautious optimism may be warranted, but bears have not completely given up.

Solana’s Challenges Ahead

Solana’s EMA is showing signs of an impending golden cross. A golden cross occurs when a short-term moving average crosses above a long-term moving average. This is generally considered a bullish signal that could mark the start of a sustained uptrend.

If this pattern is confirmed and the buying momentum continues, Solana could rise to test the resistance at $131.

A successful breakout above that level could open the door to further upside towards $136, potentially even $147.

SOL Price Analysis. Source:Transactions.

However, downside risks remain if buyers fail to hold on to the recent gains.

If SOL falls back and loses the key support at $124, this could trigger more selling pressure, pushing the price down to $120.

If the downtrend strengthens from there, SOL could revisit deeper support at $112.