This crypto report provides a comprehensive overview of the cryptocurrency market in January 2025, leveraging on-chain data to analyze key metrics across various blockchain networks. We'll delve into price movements, market sentiment, network activity, and specific trends for Bitcoin, Ethereum, and Solana.

January 2025 Crypto Report Key Takeaways:

- Donald Trump’s inauguration as the U.S. President boosted crypto sentiment, with expectations of a more favorable regulatory environment driving Bitcoin (BTC) to an all-time high of $109,000.

- Bitcoin gained 9.29% in January, and Solana (SOL) soared 22.3%, fueled by strong on-chain activity, while Ether (ETH) posted a modest 1.28% decline despite network growth.

- U.S. spot Bitcoin ETFs saw a 6.7% increase in inflows to $4.8 billion, and institutions like MicroStrategy continued aggressive Bitcoin acquisitions, signaling sustained confidence in crypto’s long-term potential.

- In contrast, U.S. spot Ether ETF inflows plummeted 95%, dropping from over $2 billion in December to just $101.15 million in January, signaling waning investor interest.

- Key events like the FOMC meeting, the SEC’s new crypto working group, and the EU’s MiCA regulations influenced market dynamics, highlighting the growing role of regulatory frameworks in shaping crypto’s future.

- What to Look for in February’s Key Events and Crypto Report

Bitcoin Report: BTC Surges to $109K Amid Optimism, But On-Chain Data Shows Mixed Signals

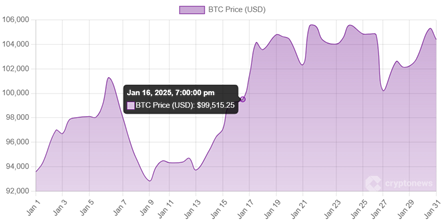

Bitcoin posted over a 9% gain in January, reaching an all-time high of $109,000 on Jan. 20, fueled by optimism surrounding Trump’s crypto-friendly stance following his inauguration.

However, on-chain data showed a mixed picture: the number of transactions declined 10% to 11.5 million, while active wallets fell 9.5% to 23.8 million, and new wallets dropped 6% to 10.1 million.

Bitcoin ETFs in January 2025

US spot Bitcoin ETF flows rebounded, with $4.8 billion in new inflows, marking a 6.7% increase from December’s $4.5 billion, reflecting growing institutional interest.

Ethereum Report: Ethereum Slips in January Despite On-Chain Growth

Ether (ETH) posted a modest 1.28% loss in January, reflecting market volatility despite strong on-chain activity.

.png)

The number of transactions on Ethereum grew 4.3% to 37.9 million, while active wallets grew nearly 5% to 15.6 million, and new wallets grew 2.6% to 3.9 million, indicating continued engagement with the network.

Validator performance was strong, with staking revenue surging 31% to $274.3 million, driven by increased staking activity.

Transaction fees remained stable at $34.7 million, a slight 0.3% uptick from December.

Ethereum Top Gainers and Losers in January

In January 2025, Ethereum-based altcoins saw significant price fluctuations driven by market sentiment and ecosystem developments. Some tokens experienced impressive rallies due to increased adoption and new protocol upgrades, while others struggled with declining liquidity and investor sell-offs. The competition among Layer 2 solutions and DeFi projects also influenced price action, with certain coins outperforming the broader market. Here are the top gainers and losers on Ethereum in January 2025.

Ethereum ETFs in January 2025

Ether ETF inflows dropped sharply to $101.15 million, a 95% decline from December’s $2 billion, signaling waning institutional interest.

Solana Report: Solana Surges in January with Strong On-Chain Growth

Solana recorded an impressive 22.3% return in January, outperforming many major crypto amid rising market optimism.

.png)

The network saw a surge in on-chain activity, with transactions up 13% to 3.5 billion, reflecting increased user engagement.

Meanwhile, the number of active wallets rose 9% to 151.2 million, and new wallets soared 22% to 640.5 million, highlighting Solana’s expanding user base and strong adoption.

Solana Top Gainers and Losers in January

Solana saw a wave of interest in January as President Donald Trump and First Lady Melania Trump both launched official crypto tokens on the chain. While these were met with mixed feelings, this was undoubtedly a moment for the history books. Aside from the official presidential coins, here are the top gainers and losers of the month.

What to Look for in February’s Key Events and Crypto Report

Here’s a list of key macroeconomic events/metrics in February 2025 that could affect crypto:

- Consensus Hong Kong Summit (Feb 18-20): Hong Kong hosts one of the largest crypto conferences, aiming to attract 10,000 attendees as it positions itself as a global digital asset hub.

- MiCA takes effect (Q1 2025): The EU’s landmark crypto regulation is now in force, impacting global crypto exchanges and stablecoins like Tether (USDT), which may face trading restrictions in the EU due to non-compliance.

The crypto market in 2025 is expected to see significant changes driven by technological advancements and regulatory decisions.

The approval of spot Solana ETFs in the U.S. could significantly boost the Solana price. In addition, AI-powered crypto trading is expected to become a major trend, with AI bots potentially outperforming human investors in terms of efficiency and market insight.

However, there are also challenges to consider. AI-powered scams are becoming increasingly sophisticated, and crypto investors need to be aware of these threats.

The new administration in the U.S. is expected to foster a more innovation-friendly crypto regulatory environment.

Increased institutional and governmental crypto adoption is also on the horizon, fueled by potential advancements like a U.S. Bitcoin Reserve Act.

Finally, the change in SEC leadership under Paul Atkins also rekindled hopes for greater regulatory clarity and a potential resolution to the SEC’s case against Ripple.

However, before jumping on the bull train, crypto investors should carefully consider the current economic landscape. For more detailed information, check out Cryptonews price predictions for Bitcoin, Ethereum, and Solana.