The cryptocurrency market continues to see strong fluctuations as a Dogecoin whale has just made a huge transaction, transferring 100 million DOGE (worth about $25.42 million) to Binance. The move immediately sparked debate about the price trend of Dogecoin in the coming time, especially in the context that the market is closely monitoring technical and macro factors affecting this digital currency.

Whale Transactions and Impact on DOGE Price

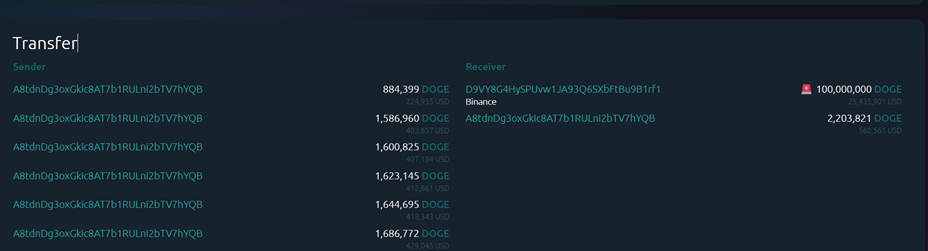

According to data from Whale Alert, the whale wallet “A8tdnDg3oxG” made a transaction worth millions of dollars, however, the identity of the owner has not been determined. Typically, when a large amount of cryptocurrency is transferred to an exchange, it can be a sign of potential selling pressure, leading to concerns that DOGE price may be under pressure.

Source: Whale Alert

However, the market has not recorded any significant decline immediately after this transaction. Experts say that if whales decide to sell all of this DOGE, the price may have difficulty maintaining the important support level. On the contrary, if this is just a move to restructure assets, the impact may not be too big.

Dogecoin Is Forming a Strong Volatility Pattern

Analyst Ali Martinez commented that Dogecoin is forming a symmetrical triangle pattern on the hourly chart. This is a pattern that often appears before strong fluctuations, with the possibility of an increase or decrease of up to 25%. If DOGE breaks this pattern to the upside, the price could reach significantly higher. On the contrary, if Dogecoin fails to hold the important support level, a deeper decline may occur.

DOGE/USDT hourly chart | Source: Ali Martinez/X

Technical investors are closely watching the signals from this pattern to determine whether this is a buying opportunity or if they should wait for clearer signals.

Dogecoin ETF – A Growth Momentum Factor?

Besides technical factors, an important event that is attracting the attention of the market is the proposal to list a Dogecoin spot ETF by Grayscale. If approved by the US Securities and Exchange Commission (SEC), this will be a big step for Dogecoin, helping the coin attract more capital from institutional investors.

The interest in the Dogecoin ETF shows that the traditional financial market is increasingly accepting cryptocurrencies, even for a coin that originated from a meme like DOGE. The approval of an ETF could create a big push, bringing Dogecoin closer to widely recognized cryptocurrencies such as Bitcoin or Ethereum.

Conclusion

The whale’s large transfer of DOGE to Binance puts Dogecoin on the verge of a period of high volatility. Investors should closely monitor market signals, including the symmetrical triangle pattern on the technical chart and developments surrounding the Dogecoin ETF. If market sentiment is positive, Dogecoin could take advantage of this opportunity to break out. Conversely, if selling pressure increases, DOGE price could face major challenges.

As the cryptocurrency market continues to grow and receive attention from major financial institutions, Dogecoin can continue to demonstrate its potential as not only a “meme” coin but also a valuable asset in the global cryptocurrency ecosystem.