Outflows Continue to Increase, Marking a Negative Trend

Last week, the crypto market recorded outflows of $508 million, marking the second negative outflow in 2025. This brings the total outflows over the past two weeks to $925 million, reflecting a significant change in investor sentiment after an 18-week bull run that saw the market accumulate $29 billion.

The decline comes as investors weigh key economic factors, including monetary policy, inflation, and issues related to US trade tariffs. In particular, the Federal Reserve's hawkish stance coupled with CPI inflation data have contributed to increased market volatility.

Bitcoin Hit Hard, Altcoins Maintain Gains

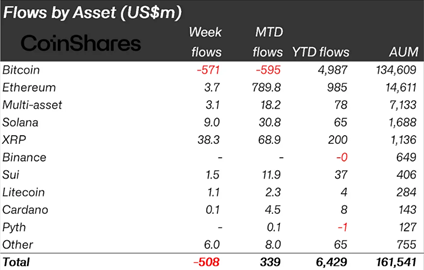

According to the latest CoinShares report, Bitcoin (BTC) was the most affected asset, with outflows reaching $571 million. In addition, some traders increased their short positions, leading to an inflow of $2.8 million into Bitcoin short products.

Notably, the majority of outflows came from the United States, with outflows reaching $560 million. The decline raised concerns about the country's economic policies, especially after the inauguration of the US President.

Cryptocurrency outflows last week. Source: CoinShares

While Bitcoin struggled, the altcoin market maintained positive momentum. XRP led the way with $38.3 million in inflows, bringing the total inflow since mid-November 2024 to $819 million. XRP’s strong performance comes amid growing expectations that the US Securities and Exchange Commission (SEC) may approve an XRP ETF.

If an XRP ETF is approved, this could attract more inflows from large institutions, helping to strengthen XRP’s position in a volatile market. In addition, the SEC’s recent approval of Bitwise’s XRP ETF application and the launch of an XRP ETF in Brazil via Hashdex further fueled the bullish sentiment.

In addition to XRP, several other altcoins also attracted significant inflows. Solana (SOL) recorded $9 million, Ethereum (ETH) attracted $3.7 million, while Sui received $1.5 million. This suggests a potential shift of investors from Bitcoin to altcoins with stronger technical foundations and high growth potential.

Markets Continue to Be Influenced by US Economic Data

The volatility in the cryptocurrency market may continue to be influenced by important economic data this week. Specifically, the US GDP data due out on Thursday and PCE inflation data on Friday will provide more insight into the Fed's policy direction.

With Bitcoin's increasing sensitivity to macroeconomic factors, unfavorable reports could increase selling pressure. Conversely, altcoins appear to be attracting interest from investors looking for opportunities to diversify their portfolios.

The sharp difference in investor sentiment between Bitcoin and altcoins could signal a change in market structure. Some experts are seeing the possibility of the market entering a new "altcoin season", with digital assets other than Bitcoin becoming the focus of capital flows.

In this context, investors will need to closely monitor economic developments and financial policies to have a strategy that suits the volatility of the cryptocurrency market.