Bitcoin (BTC) hit a 15-week low on Wall Street’s opening day on February 25, as selling pressure from the US continued to push BTC lower.

BTC/USD daily chart | Source: TradingView

BTC Price Enters Bear Market

Data from TradingView shows BTC/USD is approaching $86,000.

Bitcoin is currently trading at its lowest level since November 13, struggling to find momentum amid traders’ concerns about the impact of a massive liquidation.

In the past 24 hours alone, the total value of liquidations across the cryptocurrency market has reached nearly $1.6 billion, pushing market sentiment deeper into “extreme fear” territory.

Liquidating Cryptocurrencies | Source: CoinGlass

After falling 20% from its all-time high just a month ago, Bitcoin has officially entered a technical bear market, according to financial and trading data platform Barchart.

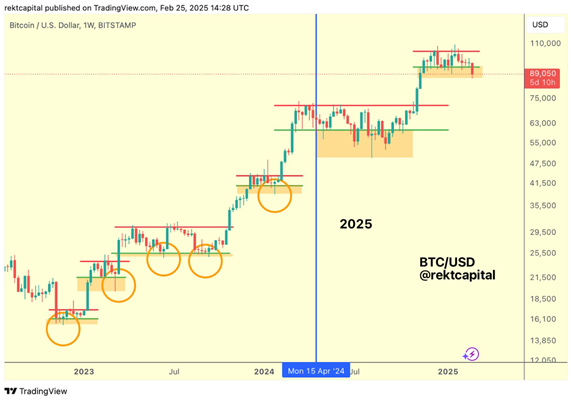

“BTC is now below the low end of its reaccumulation range, which is currently underway,” noted prominent analyst Rekt Capital.

Rekt Capital has released a weekly chart, highlighting key structures in BTC’s price action since the end of the macro bear market in late 2022.

In a post on X in early February, Rekt Capital also mentioned such a downward deviation multiple times, calling it a “good buying opportunity.”

BTC/USD weekly chart | Source: Rekt Capital/X

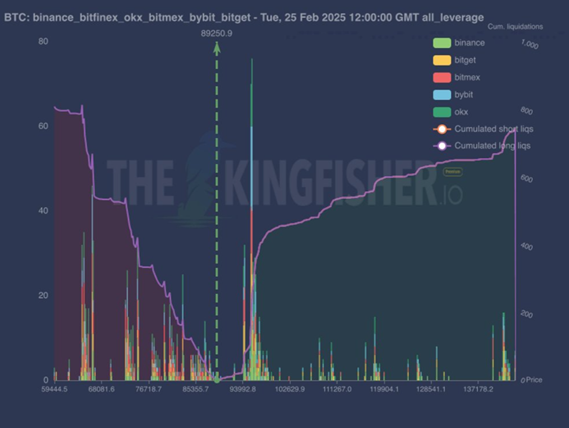

In terms of price prospects, analyst TheKingfisher predicts that BTC could fall to lower levels, near the previous high of $73,800 and March 2024.

“Long liquidations (left bar) are concentrated in the $68,000-$77,000 range. Short liquidations (right bar) are significantly higher in the $103,000-$138,000 range,” he noted, analyzing the relevant chart.

“There is currently an imbalance in favor of liquidations above current levels. Risk: The large cluster of Long liquidations below could act as support, but if this level is lost, it could trigger a sharp decline. Target: Shorts could target the $103,000 range.”

Dữ liệu thanh lý Bitcoin | Nguồn: TheKingfisher/X

Warning of Declining Institutional Demand for Bitcoin

In terms of macroeconomic factors, QCP Capital believes that inflation in the US is no longer a major concern for Bitcoin.

“Overall, equities, fixed income, and gold have largely shrugged off previously negative data, while Bitcoin has remained flat,” QCP noted in a Telegram post.

QCP also stressed that the road ahead may not be smooth, even amid growing institutional interest in Bitcoin.

“We remain cautious,” QCP concluded.

“Recent BTC demand has been driven largely by institutional investors like MicroStrategy, through equity-linked bond issuances. With crypto-related issuances accounting for approximately 19% of total issuances over the past 14 months, the market for this form of funding may be approaching saturation — which could dampen institutional demand if spot prices continue to move sideways.”