Altcoin ETFs may not see significant investor interest even if they launch in the US this year, according to investment experts interviewed by Cointelegraph.

To date, asset managers have filed more than a dozen applications to launch altcoin ETFs in the US, including Solana, XRP, Litecoin, and several others. Analysts expect many of these funds to be approved by regulators by 2025.

However, according to Katalin Tischhauser, head of research at Sygnum, demand for altcoin ETFs will be less robust than for major cryptocurrencies like Bitcoin and Ether. The main target audience will still be individual investors rather than large institutions.

“There’s a lot of excitement around these ETFs, but no one can pinpoint where the demand is going to come from,” Tischhauser said.

She estimates that inflows into altcoin ETFs could range from a few hundred million dollars to around $1 billion, far less than the more than $100 billion in net assets held by U.S. Bitcoin ETFs.

Bryan Armour, director of passive strategy research at Morningstar, also said that Bitcoin ETFs have attracted a lot of interest from institutional investors as they wait for a mainstream investment product. However, for altcoins, he said: “I don’t expect a large number of investors to wait for an ETF structure to invest in these cryptocurrencies.”

Altcoin ETF Awaiting US Regulatory Approval | Source: Bloomberg Intelligence

Early Investors Already Own Altcoins

According to Tischhauser, crypto-savvy investors interested in altcoins like Solana are likely to already own them through on-chain trading platforms or spot exchanges.

“If someone was really interested in Solana or Dogecoin, they probably would have bought them a long time ago,” Armour noted.

Meanwhile, asset managers and institutional investors tend to only consider holding altcoins if they are included in a passive index fund that tracks the entire crypto market, Tischhauser said.

On Feb. 20, Franklin Templeton launched an ETF that holds both spot Bitcoin and Ether, becoming the second crypto index fund to launch after Hashdex launched the Nasdaq Crypto Index US ETF (NCIQ) on Feb. 14.

Currently, these funds only hold BTC and ETH, but could expand their portfolios if approved by regulators.

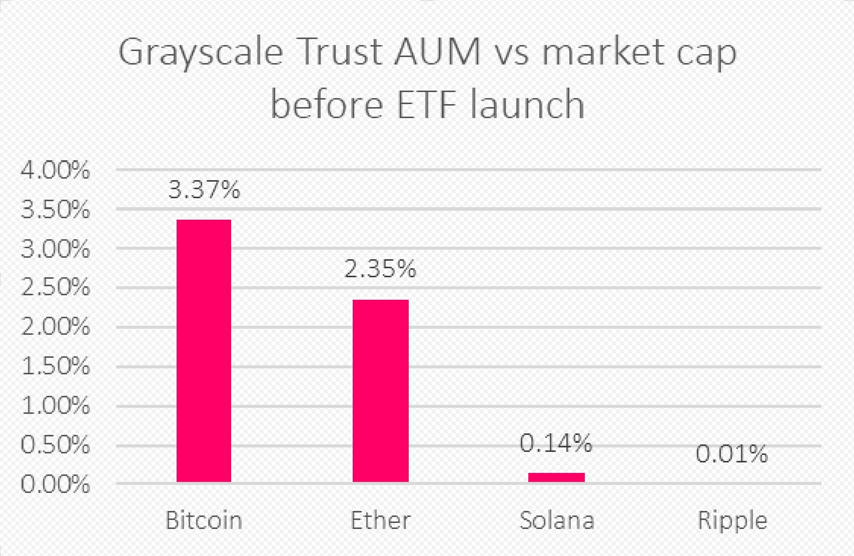

Comparing Grayscale Asset Management’s Net Assets Before ETF Launches Across Different Cryptocurrencies to Gauge ETF Demand | Source: Sygnum Bank

Benefits of ETFs and Market Outlook

Despite skepticism about demand, some asset managers remain bullish on the potential of altcoin ETFs, citing research from JPMorgan that forecasts that inflows into these funds could exceed $14 billion.

Federico Brokate, CEO of 21Shares in the US, believes that even crypto-native investors can benefit from owning altcoins through ETFs.

“The core benefits of ETFs lie in transparent pricing and secure custody,” Brokate stressed. 21Shares is currently seeking approval for a series of altcoin ETFs, including funds holding Solana, XRP, and Polkadot.

Additionally, ETFs make it easier for investors to access altcoins, with just one click in their overall portfolio.

He also pointed out that professional financial advisors, especially independent investment advisors (RIAs), are interested in adding altcoin ETFs to their portfolios as a way to differentiate themselves from the competition.

Independent RIAs are also the first to adopt Bitcoin and Ether ETFs after they are approved by US regulators in 2024.

According to Matt Horne, head of digital asset strategy at Fidelity Investments, for new investment products like crypto ETFs, “the level of adoption will vary across investor groups.”

“Some investors have been very early on in Bitcoin, but for others, adoption will happen gradually over time.”