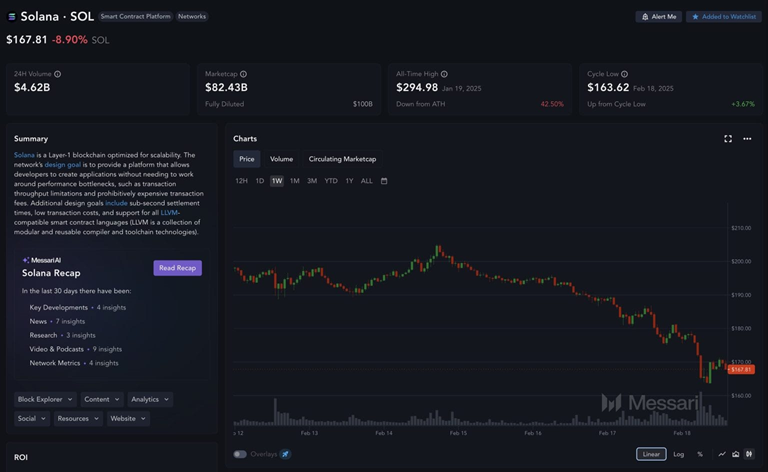

The Solana price is selling off as the FTX unlock and the Libra (LIBRA) token scandal rocks the ecosystem, as calls for better launchpad self-regulation get louder.

But looking past the noise, there are many reasons to be cheerful for Solana holders and users, from scaling-booster Firedancer to the Winternitz Vault innovation, which makes it among the first of the top blockchains to bring quantum resistance to its ecosystem.

The Chairman of publicly traded Sol Strategies, Antanas Guoga (aka Tony G), put it like this in an X post when surveying the LIBRA wreckage: “This is a complete clown show. The $LIBRA launch will put people in jail… Silverlining = sentiment changed this weekend. I hope we use this as fuel and change for the better!”

In other words, the difficulties the chain is currently struggling with today are creating the conditions for retesting SOL’s all-time high of $294, achieved on 19 January this year. Sentiment is shifting in a good way, to a focus on building.

Solana price is not going to $50

The days when Solana was derided as a ‘Sam Coin’ were thought to be long gone, but alongside the Libra debacle, the shadow of FTX has come back to throw shade over the token.

The remaining stash of SOL held by the defunct exchange will be released on 1 March and there is much gnashing of teeth regarding a possible selloff of the 11.2 million unlocked SOL tokens, mostly owned by Galaxy Digital and Pantera.

What was once $2 billion worth of SOL has been declining in value with every passing hour. The unlocked bag has shriveled in value to $1.8 billion.

However, as things stand, it is probably more likely that the two institutions will hold their SOL for now. After all, why sell into a falling market when the second wave of the bull market could be just around the corner?

Moving on from what are likely to be overblown worries of liquidity stress that could push SOL down to a sub $50 price level, the Libra fallout and the meme coins landscape are more cause for concern.

However, here again predictions of existential doom for Solana are wide of the mark. Let’s not forget that in crypto, 20% drawdowns in a bull market are par for the course – in fact, they provide the fuel to fire up the next leg higher.

SOL is trading at $170 after dipping as low as $163 in the past 24 hours.

Nevertheless, even before the launch of Libra on 15 February, concerns arising from the Tsunami wave of meme coin launches hitting the marketplace were growing.

Solana meme coins and Gresham’s Law – good money fights back

Although meme coins have showcased Solana’s generally robust capabilities to the world, if we leave congestion matters to one side, their popularity among traders meant that they always posed the danger of ‘bad money driving out good’, to invoke Gresham’s Law.

Of course, Gresham’s Law refers to commodity money – that’s to say metal coinage. When two coins of the same face value are in circulation but with different metal values in each, the coin with the least metallic value will tend to dominate in circulation, while the more valuable coin will tend to be removed from circulation and hoarded.

Applied to meme coins versus all other coins, the popularity of meme coins with crypto traders reminds us that the industry is still a speculative risk asset, where the worth of the underlying technology is yet to be determined. But there is one thing meme coins have definitely proven themselves to be good for, and that is capturing, gene-like in a bottle, an internet meme, trend, brand, persona, and then monetizing it, as President Donald Trump and his wife Melania have done with their coins.

With so much interest (and liquidity) flowing into meme coins, does this not impinge on capital flows into projects building real products that will/could ultimately prove in the real economy the worth of crypto’s much-vaunted decentralized networks? Are meme coins driving out the good coins, and is Solana the enabler of this unfortunate turn of events?

Which brings us to LIBRA. Here we have a crypto asset that is not actually a meme coin, but certainly seemed to trade like one – it went up like a rocket and came down like a stick. Libra claimed to be an incubator, accelerator and venture fund for Argentina’s small businesses all rolled into one.

Here’s the Libra ‘about’ blurb reproduced on CoinMarketCap: “Liberal Argentina grows!!! This private project will be dedicated to encouraging the growth of the Argentine economy by funding small Argentine businesses and startups. The world wants to invest in Argentina.”

How it all went wrong for Libra and who is going to prison?

But it all went wrong very quickly – or right if you were on the right side of the alleged rug pull. It all began well when the President of Argentina Javier Milei endorsed the coin, propelling Libra to a market cap of nearly $4.5 billion only for the price to collapse when Milei reversed his endorsement.

Meanwhile, crypto sleuths – actually, it didn’t take much sleuthing, as there’s a video we’ve all watched right (see below) – discovered what appear to be links between the team (Kelsier Ventures and its CEO Hayden Mark Davis) behind the Trump and Melania coins and Libra.

Davis, by his own admission, is sitting on $100 million of Libra traders’ funds. When it was put to him that he should start trying to make people whole, he replied, “I need somebody trustworthy to come help me because I don’t know what the f**k to do. I don’t want to be blamed for something that I had no intention of creating.”

Allegedly, at the center of the nexus of possible insider interests sits Meteora and Jupiter, Solana decentralized exchange (DEX) trading platforms. Ben Chow, co-founder of both DEXs, resigned on Monday as the Libra firestorm grew in intensity.

The news was communicated by Meow, the pseudonymous co-founder of Meteora and Jupiter.

In a long tract (see below), Meow is in a hurry to distance Jupiter from Meteora from the Libra project and to cut Chow loose. However, by his/her own admission, the damage has already been done and the suspicions aroused.

The repetition of the formulation that Meow never received tokens “inappropriately” begs the question: How might an appropriate token receipt occur?

Hiring a big-name lawyer to conduct an independent investigation sounds all well and good, but the horse has already bolted. Besides, the lawyers will be investigating their own client, which may put the reputable firm of Fenwick & West in something of a bind.

The big picture: unlike Bitcoin and Ethereum, Solana has future-proof quantum-resistance

Now, let’s get to the serious stuff, upon which chains really do break or make. Development on Solana continues at a brisk pace as the community awaits the implementation of Firedancer, which holds out the prospect of massively increasing the chain’s transaction throughput.

Elsewhere, Solana has its first Layer 2 in the works being built by a project called Solaxy.

But let’s concentrate on the big picture – quantum resistance. Regardless of the timescales we want to settle on for when usable quantum machines will be in existence, they are coming.

Be it five years or two decades, quantum machines are a threat, and chains need to be thinking about how they will enhance their cryptographic security to protect users.

Well, Solana, as in many other things, is ahead of the game – Winternitz Wallets bring quantum-resistance to the chain.

In January a Solana dev named Dean Little introduced the Winternitz Vault as an optional feature. Using the new wallet system means that for each transaction a new key pair is generated – hash-based Winternitz One-Time Signatures.

Another neat feature is that funds involved in a transaction are split into two parts – transfer and refund. Funds not subject to transfer are inaccessible to a would-be attacker.

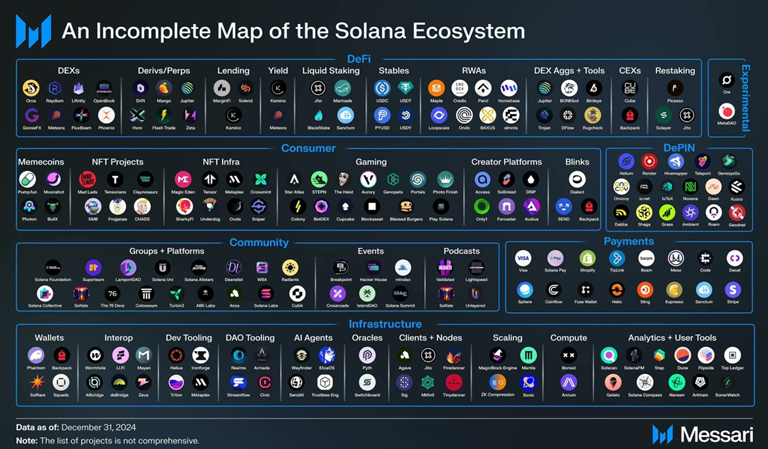

When some people say that nothing is built on Solana, that it is all about meme coins, maybe show them this:

Solana is probably trading at a discount right now, so this could be the best entry point opportunity of the year.

If you prefer a more regulated route and want exposure to validator yield, you could also check out the MicroStrategy (now called Strategy) of Solana, Sol Strategies, we mentioned earlier.

Sol Strategies trades OTC in the US under the CYFRF ticker and has its primary listing on the Canadian Securities Exchange (ticker: HODL).